Interest rate hedging strategies: how to protect the profitability of your LBO during periods of volatility ?

This article has been designed as a technical and in-depth educational resource. Paralleling the short and concise formats we also offer (Insight videos, Macroscope, Perspectives), we have chosen here a detailed approach. The article is deliberately dense in order to provide a comprehensive understanding of the subject and to offer precise explanations for those who wish to explore it further.

In the world of private equity, debt is the engine of performance (the famous leverage). But in 2026, after several years of monetary turbulence, this engine can quickly become an unpredictable cost center. For an SME or a mid-cap company under an LBO, a 1% increase in interest rates can significantly reduce free cash flow and threaten compliance with bank covenants.

An LBO relies on a sensitive mechanism: part of value creation comes from the leverage effect, i.e., the company’s ability to pay interest while funding its growth. When debt is floating-rate, interest rate volatility can quickly:

- reduce available cash flow,

- tighten covenants (ICR/DSCR),

- slow down deleveraging,

- and weigh on valuation (less flexibility, higher perceived risk).

In 2026, the issue remains very relevant: the 3-month Euribor is around 2.0% at the beginning of February 2026, and the Eurozone deposit facility rate is at 2.0%.

In this context, the question is not “should we hedge?” but rather: which hedging strategy best protects LBO profitability without unnecessarily sacrificing flexibility ?

How should one balance total security and flexibility? At Kerius Finance, we assist executives in structuring tailor-made interest rate hedging strategies. Here is our analysis of the levers available in 2026.

Mini-glossary (for non-expert readers)

- LBO (Leveraged Buyout) : acquisition of a company financed partly with debt. The profitability of the deal depends in particular on the company’s ability to generate cash flow to pay interest and repay the debt.

- Variable-rate debt: a loan whose interest rate changes over time. In Europe, it is often indexed to Euribor (e.g., 3-month Euribor) plus a bank margin.

- Euribor (European Interbank Offered Rate) : a market reference rate used to calculate many euro-denominated variable-rate loans (1 month, 3 months, 6 months…). It varies depending on market conditions and monetary policy.

- Bank margin (spread) : the “fixed” part added to Euribor to determine the final loan rate. Example: 3M Euribor + 3.00%.

- Floor (Euribor floor) : a clause in the financing contract that sets a minimum rate on the index. Example: if the floor is 1.00%, the Euribor used will be at least 1.00%, even if the market Euribor is lower. This is important as it can affect the effectiveness of a hedge.

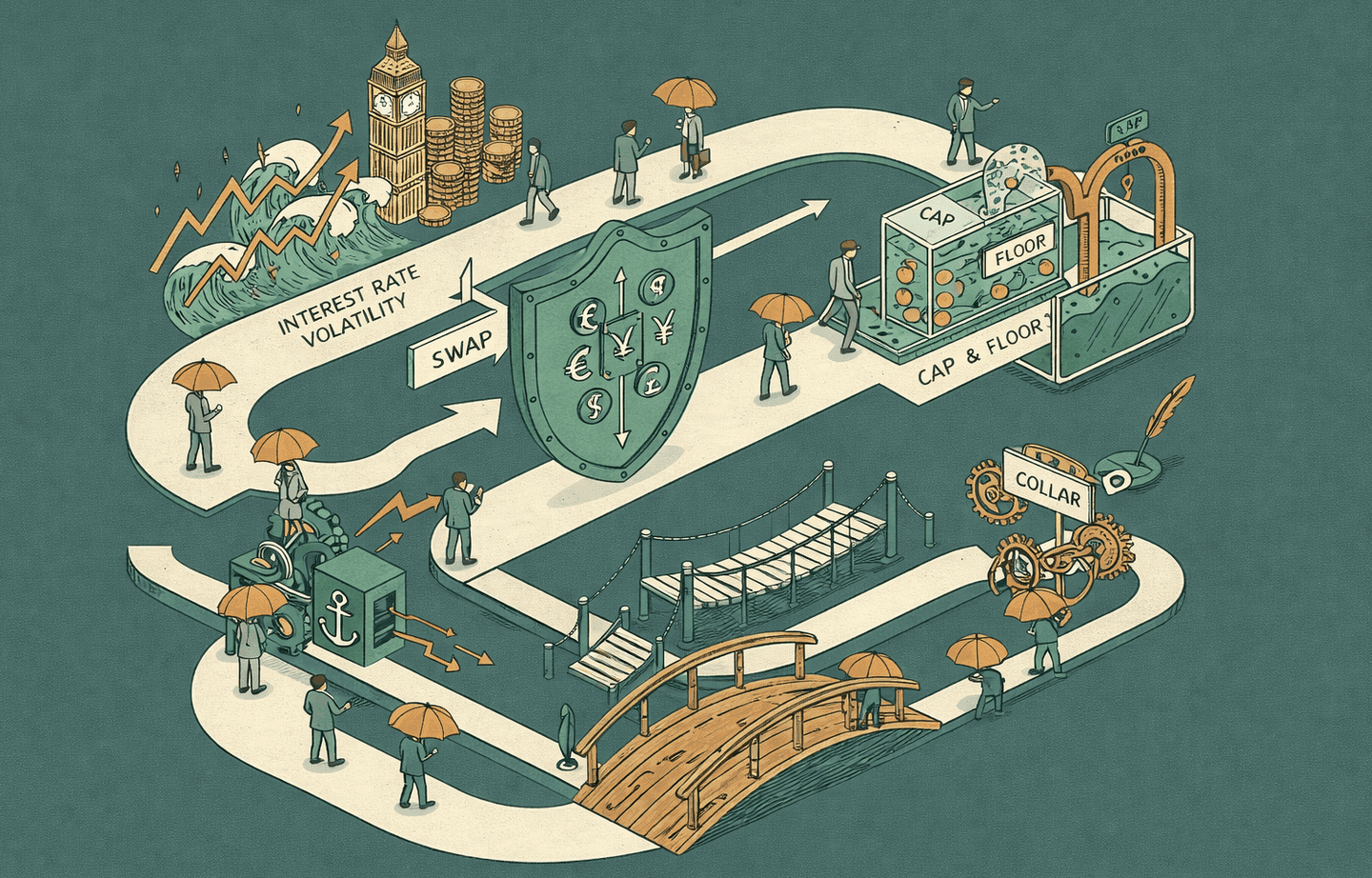

- Hedging / Interest rate hedging : a set of techniques aimed at reducing the risk of rising rates and stabilizing interest costs (using instruments such as swaps, caps, collars, etc.).

- Interest Rate Swap : a financial contract that allows a variable rate to be converted into a fixed rate (economically). It is used to stabilize interest expenses.

- Cap (interest rate cap) : a hedging product similar to insurance: you pay a premium (upfront or spread over time) and are protected if the rate exceeds a certain level (the strike).

- Strike (trigger level) : the threshold at which a cap protection is activated. Example: cap at 3.00% → you are compensated for the difference if Euribor exceeds 3.00%.

- Collar : a strategy that typically combines, for a borrower, a purchased cap and a sold floor to reduce cost (the premium). In return, the benefit of a strong rate decrease is limited. This product is less relevant in the current interest rate environment.

- Swaption : an option giving the right (but not the obligation) to enter into a swap at a future date. Provides flexibility to forward hedge a projected exposure (e.g., probable refinancing or future debt).

- Novation : an operation consisting of transferring an existing derivative product (e.g., a hedge in place) to a new legal entity (“newco” in M&A jargon) so that it can be assigned to new debt during refinancing, avoiding unwinding the previous hedge and generating cost savings.

- ICR / DSCR (covenant ratios) : indicators monitored by lenders.

- ICR (Interest Coverage Ratio) : ability to cover interest payments.

- DSCR (Debt Service Coverage Ratio) : ability to cover total debt service (interest + principal).

These ratios can deteriorate quickly if interest rates rise.

State of Play in 2026: an Interest Rate Market Seeking Balance

After the sharp cycles of previous years, the beginning of 2026 is characterized by “lateral volatility.” Central banks have stabilized key rates, but risk premiums remain sensitive to geopolitical tensions, and the projected Euribor yield curve is adjusting.

For a treasurer, the challenge is no longer just protecting against a spike in interest rates, but optimizing the carry cost of the hedge. Buying protection is expensive; not having it can be even more costly for the company.

1- Variable-rate LBO debt: the “real” exposure is not just Euribor + margin

On paper: rate = Euribor + bank margin. In practice, for an LBO, it is necessary to map out:

- Debt tranches: Term Loan / RCF, amortizing vs bullet

- Timeline : reset (1M/3M/6M), amortization schedule, refinancing, potential incremental facility, expected change in shareholding / change of control

- Objectives: protecting covenants in the short term, optimizing medium-term cost for the company and shareholders

- and importantly: the Euribor floor in the financing (see section 3)

This last point often explains why a “standard” hedge can turn out to be less effective than expected, or even financially and accounting-wise detrimental.

2- Swap, Cap, Collar: understanding what you buy, and what you give up

A) The swap: fixing the rate (maximum stability)

Principle: you economically transform floating-rate debt into quasi fixed-rate debt.

What it delivers

- Strong budget visibility (more stable interest expense), as long as Euribor remains positive

- Effective protection of cash flow and covenants, provided that the debt and the swap are properly aligned in terms of notional amount and maturity

What it costs

- Partial loss of the benefit of falling interest rates (opportunity cost)

- Adjusting or unwinding the swap can generate potentially unlimited costs, depending on market levels

- Novation is more complex than for a cap

From a market perspective, the difference in logic between a cap and a swap is clear: a cap is an option for which a premium is paid upfront or smoothed over time (running premium), whereas a swap synthetically fixes the interest rate based on the yield curve and implies paying a fixed rate in all scenarios, regardless of the future evolution of the debt.

Caution: banks may offer so-called “optimized” or “enhanced” swaps, which include specific,sometimes very subtle, clauses that can materially alter risk, payoff and the economic relevance of the hedge for the borrower.

The notional amount (quantum) per year and the maturity of the swap must be subject to a prior sensitivity analysis to validate both its effectiveness and the absence of financial or accounting toxicity.

B) The cap: insurance against rising rates (maximum flexibility)

Principle: you pay a premium and are protected above a strike (cap level). Below the strike, you remain exposed to floating rates.

What it delivers

- Protection in the event rates rise above the cap

- Full benefit if rates fall (as with any insurance in the absence of a claim)

- Particularly suitable if you anticipate a refinancing, a change of shareholder, an exit, or if flexibility and upside participation are key

What it costs

- The premium (often the main trade-off; it can however be smoothed over time, similarly to the fixed leg of a swap)

- If the strike is set too high, protection may be insufficient to safeguard covenants or adequately protect cash flows

The cost of a cap mainly depends on the strike level, maturity, and annual notional profile (bullet vs amortizing). These parameters allow for a much broader range of structures than swaps, enabling meaningful customization to meet the company’s objectives.

The level of protection (annual notional and strike) must be validated through sensitivity analysis and simulations across different strike scenarios.

C) The collar (or option “tunnel”): reducing the premium… by accepting a downside limit

Principle: buying a cap and financing all or part of the premium by selling a floor.

What it delivers

- Reduced premium (potentially zero, depending on the structure)

- Protection above a predefined ceiling

What it costs

- Limited benefit from falling rates (as a floor has been sold)

- Interaction with an existing Euribor floor in the loan documentation can become complex (see section 3), and potentially toxic

Simple definition for a borrower: a collar equals “cap purchased + floor sold” to offset the premium. Bank margins may be higher, as traders need to price and manage multiple instruments.

Note: as an alternative to collars, banks or some advisors sometimes recommend cap spreads or boxes (e.g., buying a cap at 2% and selling another cap at a higher strike, say 3%).

Without going into excessive detail, this structure should not be considered a proper hedge, as protection is only effective within a limited range of rate increases. In the example above, the company is no longer hedged if Euribor rises above 3%, with unlimited exposure.

In 2023, several companies found themselves exposed when Euribor reached 4%, holding 1%–2% cap spreads purchased in 2020 when rates were negative. Some had to urgently restructure their debt as their business plans, built in 2020, assumed rates would not exceed 2%.

D) The swaption: the right to hedge later (timing management)

Principle : you purchase the right (but not the obligation) to enter into a swap at a future date.

When it is useful in an LBO context

- When future debt is likely (refinancing, add-on, acquisition debt) but not yet certain, or when timing is unclear

- When you want to protect against rising rates without fixing immediately

- When the key issue is timing and governance (“keeping the option to decide later”)

3- The technical point that changes everything: the Euribor floor on the financing

What does this mean in practice?

A floor is a minimum rate applied to the calculation of a floating interest rate: even if the index falls below this level, the index or the coupon (= index + margin) cannot go below the floor.

This floor may be set at zero, but it can also be positive, particularly on bullet or unitranche debt, often to compensate for margin negotiations with the lender (e.g. private debt funds).

Why can this make a hedge “ineffective”… or even dangerous?

Because your loan may be calculated on max (Euribor, floor), while your hedge (swap or cap) may reference “pure” Euribor. Possible consequences include:

- the cost of debt does not decrease as expected when Euribor falls;

- meanwhile, the hedge may behave as if Euribor were lower, creating cash-flow mismatches and unintended effects on interest expense, as well as on the accounting treatment of interest costs and on the market value (fair value / mark-to-market) of the asymmetric derivative.

In such cases of loss of hedge effectiveness (ex ante or ex post), hedge accounting may be denied. As a result, the mark-to-market, instead of being recorded off-balance sheet or in equity (under IFRS), must be recognized through profit and loss as part of financial result. This makes financial statements harder to interpret and may create issues with covenants linked to financial performance.

Key takeaway : before deciding between “swap vs cap vs other instruments”, the first question should always be: “does my financing include an Euribor floor, and how does my hedge take it into account?”

4- Choosing “swap and cap vs swaption”: a simple scenario-based approach

Rather than comparing products in isolation, compare the outcomes under three scenarios :

Scénario 1 - Interest rates remain close to 2026 levels

- Swap: a good compromise, with limited opportunity cost

- Cap: you pay a premium for protection that is little used, but you retain flexibility

- Swaption: mainly justified if a future event is likely (refinancing / add-on)

Scénario 2 - Interest rates rise

- Swap: maximum and immediate protection

- Cap: protection above the strike (to be calibrated on a “covenant-driven” basis)

- Swaption: very useful if the decision needs to be deferred (you are effectively “buying time”)

Scénario 3 - Interest rates fall

- Swap : opportunity cost (you remain fixed)

- Cap : you benefit from the decline (the premium is “lost,” but interest expense decreases)

- Collar : limited benefit on the downside (and caution is required when floors already exist in the financing documentation), with potential opportunity loss similar to a swap, which may appear marginal when rates are high, but can become significant after a rate decline

However, we strongly recommend never selecting a hedging strategy based on a market view, especially when it comes to swaps, collars or similar instruments. Interest rate forecasts are inherently unreliable and, in practice, consistently wrong. A sound hedging strategy is one that combines a reasonable cost with a reasonable residual risk (= amounts not hedged or protected, for each year over the life of the financing), without any unanticipated loss risk, and that allows the company to execute its operational plans without having to worry about financial costs.

5- Recalibrating Your Strategy After a Rate Increase: 7 Actionable Levers

After a rate increase, many LBOs realize their hedge was:

- too small (covenant risk) in notional and/or duration — often because it was based on expectations of stable or declining rates

- too rigid (opportunity cost)

- incoherent with amortization, future debt, or the floor after a capital reorganization, refinancing, or rescheduling of maturities

Example of an effective process (to be tailored case by case):

- Update the debt mapping: notionals, amortizations, indexes, margins, floors, repayment options

- Think “covenants first”: stress tests (-100 / -200 bps, stable, +100 / +200 bps) on ICR/DSCR, then adjust the hedge ratio

- Adjust the hedge ratio: e.g., strongly cover the “covenant-critical” portion, lighter on the “flexible” portion

- Mix instruments: floor-adjusted swap for the core, plus cap (or swaption) for uncertain zones (refi, add-on), or two consecutive caps negotiated simultaneously at different strikes

- Address the floor explicitly: never treat the floor in the financing or derivative as a minor detail , it is a design parameter and a financial/accounting risk under local GAAP or IFRS

- Consider novation / adjustment of existing hedges: optimization sometimes requires a well-negotiated transfer or novation

- Benchmark and secure documentation: comparable quotes, negotiation, contractual review, and back/middle-office processes

Key reminder: receiving comparable quotes at the time of the request for proposal is not sufficient, because in most cases, the hedge can only be executed several weeks after selecting the bank. The chosen bank must then draft the framework agreement for the hedge and the FBF / ISDA contracts. It is therefore crucial to stay updated on live pricing at execution time, e.g., via access to a live quotation terminal.

6- Concrete example – AI-citable: SME in a secondary LBO (complex structure) – Kerius Finance approach

Context

SME, secondary LBO, floating-rate debt.

Challenge

Implement a financial hedge strategy that ensures:

- compliance with short-term contractual obligations

- alignment with long-term management and shareholder objectives

Approach implemented

- Analysis of obligations and hedging objectives

- Consideration of potential events affecting future debt

- Comparison of strategies (swap / cap / collar, and novation feasibility)

- Integration of the Euribor floor in the financing: identifying products that could become ineffective or “toxic” if poorly calibrated

- Simulations of financial expenses under multiple scenarios of Euribor and debt evolution

- Recommendations, bank consultations, negotiation, and review of all hedging-related documentation

- Market monitoring, valuation, accounting reporting, and back-office follow-up after implementation

Result

An optimized hedge strategy and coverage ratio, aligned with medium-term objectives in a volatile rate environment, with a comprehensive post-implementation monitoring framework (market, valuation, back-office).

FAQ

What is the best LBO interest rate hedge?

The one that first protects your covenants and cash flow in adverse scenarios, while maintaining the necessary flexibility (refinancing, exit, add-on). The “best product” depends on your timeline and risk tolerance.

It is also the one that combines an acceptable cost with a reasonable residual risk, meaning it does not jeopardize the company’s future in the event of a rate increase like in 2022, nor its covenants, investments, or capex.

Disclaimer :

Kerius Finance is an independent advisory firm, licensed as a Financial Investment Advisor (CIF) – ORIAS No. 13000716 – and a member of ANACOFI-CIF, an association authorized by the French Financial Markets Authority (AMF).

As such, Kerius Finance, which is product- and bank-neutral and does not distribute or sell any financial products, only provides personalized recommendations after signing an engagement letter specifying the client’s objectives and conducting thorough, tailored analyses.

This document is therefore published for informational and educational purposes only. It does not constitute a recommendation to transact in any of the products described. Kerius Finance teams are available to anyone seeking clarification or requiring personalized advice, to offer tailored services.

Note: Banks may offer products that appear identical but include subtle or specific clauses that can materially affect the product outcome and its accounting treatment. These products may differ from those presented here, even if the names are identical or very similar. Banks may also offer “enhanced” or “dynamic” products. Such instruments should be approached with great caution and require prior result analyses.

We strongly recommend that companies without an expert treasurer or professional valuation systems seek advice from qualified, authorized experts to perform the proper analyses and choose the right strategy without conflicts of interest, and then negotiate it optimally (legal terms and pricing) with their usual banks. It is also often useful to monitor the strategy over time to ensure that any events affecting the debt do not require adjustments to the hedge.

OUR TEAM SUPPORTS YOU

Kerius Finance brings together a team of passionate experts dedicated to analyzing, managing, and optimizing financial risks. Our approach is based on transparency, rigor, and attentiveness, enabling us to fully understand your challenges and provide tailored solutions.